18.11.2020.

The NBS has published today the Inflation Report – November 2020, which contains the analysis of current macroeconomic developments and new projections of inflation and economic activity.

As the previous two Reports, the November Inflation Report was prepared in an environment of uncertainty as to the further evolution of the pandemic and its impact on global growth. After the initial phase of the pandemic in late Q1 and in Q2, many countries saw faster than expected economic recovery in Q3, which encouraged leading international financial institutions to revise upward the global growth outlook for this year. However, as the coronavirus began to spread again as of October, some containment measures were re-introduced and concerns about the speed of economic recovery going forward were heightened. On the other hand, November saw positive news about the vaccine, which influenced a mild increase in market optimism. However, it is still not known with certainty when the vaccine will be available and how quickly it will be distributed. All this makes it difficult to forecast the recovery of the global economy in the coming period, which reflects on uncertainty in the international commodity and financial markets.

As the rest of the world, Serbia is undertaking measures to mitigate the negative effects of the pandemic and speed up economic recovery. The results of these measures and the process of economic recovery are presented in detail in the Report.

Some of the most important findings of the November Inflation Report are the following:

“Owing to the responsible conduct of economic policy in the past years, it has been proven that Serbia's monetary policy and public finance have the capacity to fight the greatest economic and health crisis in recent history, without jeopardising the achieved low and stable inflation, and other indicators of macroeconomic stability. This is also confirmed by the fact that Serbia's credit rating has been preserved even during the pandemic, when rating downgrades across the world were more widespread than during the global financial crisis of 2008–2009. This is an acknowledgment of success of the Government and the NBS, which preserved Serbia’s macroeconomic and financial stability and a favourable economic growth outlook. At the onset of the crisis, timely and adequate monetary and fiscal policy measures were adopted, preventing a major economic downturn in the initial phase of the pandemic and later stimulating faster economic recovery. The important factors underlying the good results of the economy even amidst the pandemic have been low inflation and relative stability of the exchange rate”, emphasized Governor Jorgovanka Tabaković.

Economic recovery in most production and service sectors in the past five months was faster than expected. In Q3, s-a GDP growth is estimated to have risen by 7.7% q-o-q and to have slowed to 1.3% y-o-y.

Faster than expected was primarily the recovery in industry and trade. In addition, the yields of main crops suggest that this year's agricultural season was better than last year's season, which was also above-average. On the other hand, due to the high base effect, weaker activity in construction is expected in Q3 compared to the same period last year. On the expenditure side, q-o-q recovery was recorded primarily for private consumption and private investment, underpinned by the undertaken monetary and fiscal policy measures.

The narrowing in external imbalances as of April was consistent with NBS expectations. The lower current account deficit reflects the expected reduction in the foreign trade deficit and the primary income deficit. Working in the opposite direction was, in line with expectations, the smaller secondary income surplus in an environment of reduced labour force mobility, the global crisis and lower remittances inflows on these grounds.

Being on the recovery path in the past months, commodity exports almost reached their pre-crisis level. This was supported largely by the recovery of car industry exports which, after a significant standstill in April, almost fully normalised already in September. Trends in the car industry, one of our most important export branches, are analysed in the Text box Impact of the coronavirus pandemic on global automobile industry and the implications for Serbia. In geographic terms, after the y-o-y reduction of 37.4% in April, total exports to the EU were recovering over the following five months, recording even the y-o-y growth of 6.7% in September. The resilience of exports reflects their higher geographic diversification in the past period and the fact that exports to countries such as China and the USA remained relatively strong even during the pandemic. Exports to Russia have also rebounded, as well as exports to the CEFTA region.

“Although a new spread of the virus poses a risk, the outturn in the first nine months is consistent with our projection of the reduction in the current account deficit to around 5% of GDP this year. As in the past five years, the current account deficit will be fully covered by the net FDI inflow”, said Governor Tabaković.

In the medium run, owing to increased export capacities and the expected global economic recovery, the share of the current account deficit in GDP is likely to decline. The pace of the reduction will depend on the dynamics of the investment cycle and the relating equipment imports.

The coronavirus pandemic has not significantly affected the Serbian labour market. Owing to the undertaken economic policy measures, formal employment increased by 44 thousand persons from February until September. Almost the entire increase took place in the private sector, notably manufacturing.

“The timely and robust economic support to the Serbian corporate sector during the pandemic helped preserve wages and encouraged further employment in the private sector, which is why the domestic labour market avoided any more severe consequences of the crisis”, underscored Governor Tabaković.

The Text box Structure and dynamics of corporate costs in 2014–2019 elaborates on the improvement of the business and financial position of Serbian companies. The results of the analysis show that domestic companies used a significant portion of operating income to step up investment and enhance their competitive position, which largely helped the domestic corporate sector to more easily tackle the consequences of the pandemic, while preserving the necessary level of business activity and employment.

As economic activity decreased less in Q2 and rallied faster than expected in Q3, we have revised our projected GDP growth rate for this year from -1.5% to -1.0%. The smaller than anticipated decline in economic activity was due to the materialisation of upside risks from the domestic environment, highlighted in the August Report. Domestic factors could lead to an even better than projected outturn this year, but note should be taken of the deteriorating epidemiological situation worldwide which could result in fresh slackening of external demand and reflect on slower recovery of our exports.

On the expenditure side, a higher GDP growth projection for this year relative to August is the result of a faster than expected recovery in investment, mostly due to the implementation of infrastructure projects which was not discontinued even in Q2, as well as the maintained favourable terms of financing. By contrast to initial estimates made after the pandemic broke out, capital government expenditure was higher by 14.6% in the nine months of the year than in the same period last year, and is estimated to reach around 5% of GDP this year. On the production side, a higher GDP projection resulted from faster than expected recovery in industry and some service sectors and a better agricultural season.

We expect that the maintained favourable medium-term outlook of our country and the measures taken by the Government and the NBS will support the recovery in domestic demand which, together with further normalisation of external demand, will enable a more than complete economic recovery next year, with a GDP growth rate of around 6%.

“It has been demonstrated that the monetary and fiscal policy response was timely and well-calibrated and that the enacted measures prevented a much sharper fall in economic activity in 2020. Also, if these measures had not been taken, economic recovery would have been much slower in both 2021 and in subsequent years due to loss of production capacities and human potential“, Governor Tabaković pointed out.

Text box NBS’s projection of domestic GDP growth, its revision during the year and comparison with projections of international financial institutions contains a chronological overview of our projections and detailed arguments in favour of the upward revision of the GPD growth projection for this year. Analysis of projections for several previous years shows that the NBS’s projections were closest to the actual outturn (in 2016, 2018 and 2019) compared to those of other institutions, with growth exceeding our projections in these years.

The risks to the projection for 2021 are symmetric and associated primarily with the course of the pandemic and the related speed of economic recovery globally and at home. The risks relating to euro area growth are tilted to the downside due to a deteriorating epidemiological situation and tighter containment measures, whereas risks associated with domestic factors are skewed to the upside on account of a possibly faster than expected recovery in domestic demand.

Global economic growth and euro area growth have been supported by extremely accommodative monetary policy measures of leading central banks, and further measures have been announced by the ECB. One of the text boxes in this issue, Reviews of the Fed and ECB’s monetary strategies, deals with the adopted changes to the Fed strategy and the initiated discussion on changing the strategy of the ECB. The change in monetary strategies towards targeting an average inflation of 2% in a given period signals that interest rates of leading central banks could remain low for a longer time period, i.e. that liquidity in the international financial market could stay elevated for an extended period of time, which would reflect positively on capital flows to emerging markets, including Serbia.

In Q3, y-o-y inflation moved in line with our expectations, hovering around its average for the past seven years, and measured 1.8% in September and October. Cost-push inflationary pressures remained subdued, helped by lower global oil prices relative to the pre-pandemic level, persistently low costs in food production and the ensured relative stability of the exchange rate. Though wages and employment continued to rise in most sectors, demand-side pressures also remained weak, as reflected in core inflation moving at a low and stable level.

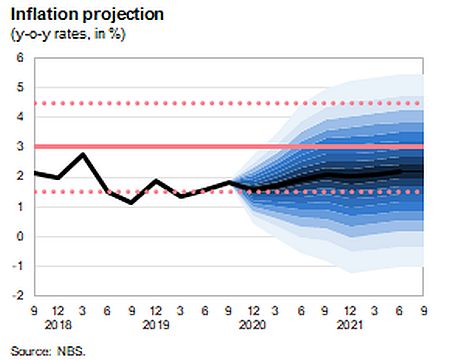

Going forward, we expect inflation to move within the lower half of the target tolerance band, closer to the lower bound, until end-2021. Such inflation movements will be supported by disinflationary pressures on account of aggregate demand and international inflation, while the effects of the previous fall in the global oil price will wane gradually. Thereafter, as the rise in economic activity and demand continues, inflation will edge up gradually towards the target midpoint of 3%, but remain below it even in 2022.

“The achieved and maintained low and stable inflation even in the conditions of the pandemic enables the NBS to continue to support economic recovery and make sure citizens’ living standard improves further”, Governor Tabaković underlined.

Compared to the August projection, the new inflation projection for 2021 is slightly higher. The somewhat higher projected inflation is due to the expected rise in food prices on account of growth in global prices of primary agricultural commodities in the period since our previous projection as well as the base effect for meat prices (seasonal growth in meat prices was absent in the May–September 2020 period most probably due to the pandemic and excess meat supply in the EU). In addition, faster than expected economic recovery has softened the disinflationary pressures from the demand side relative to the August projection.

Uncertainties surrounding the inflation projection in the short run are mostly associated with movements in fruit and vegetable prices. In the medium run, the key risks to the projection remain associated with the international environment, and relate primarily to the speed of recovery of the euro area, global prices of primary commodities and capital flows to emerging markets. In part, the risks to the projection also relate to the speed of recovery of domestic demand and movement in administered prices and food prices at home. On the whole, the risks to the inflation projection are judged to be symmetric.

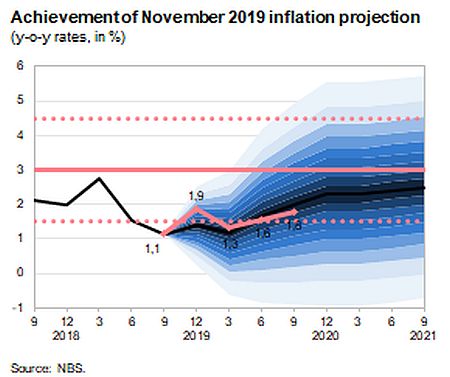

In the past year, inflation was largely aligned with the projection made and published in the November 2019 Inflation Report, which helps strengthen the credibility of the NBS and anchor inflation expectations.

In the period since the previous Inflation Report, the key policy rate was kept unchanged at 1.25%. In making such decision, the Executive Board was guided primarily by the achieved and expected effects of past monetary and fiscal policy measures aimed at mitigating the negative impact of the pandemic, as well as by the economic growth turning out faster than anticipated.

“The response of economic policy makers in Serbia was comprehensive and strong from the very start of the pandemic. As for the NBS, in the period March–June the key policy rate was cut by a total of 100 bp, down to its lowest level in the inflation targeting regime, in order to ensure a further decline in the interbank money market and dinar lending rates, and encourage credit growth, thereby triggering a faster economic recovery,” stressed Governor Tabaković. “Also, we narrowed the main interest rates corridor in March (from ± 1.25 pp to ± 1 pp relative to the key policy rate) in order to further increase monetary policy efficiency via the interest rate channel.”

Besides lowering all main interest rates, since the start of the pandemic the NBS also supported banks’ dinar liquidity via direct repo operations, FX swap auctions and bilateral purchase of dinar government bonds from banks. The NBS extended direct support to the economy and growth in dinar lending by enabling corporates to apply for loans under the Guarantee Scheme at even more favourable conditions that the ones initially envisaged in the Scheme – banks were offered the option of a “preferential” rate on required reserves allocated in dinars (regular rate plus 0.5 pp) if they extend dinar loans to corporates under the Guarantee Scheme at a rate at least 0.5 pp lower than the ceiling interest rate. Also, the NBS enabled a moratorium on loan repayment, and adopted a series of measures to minimise the adverse effects of the coronavirus on economic activity and employment, and ensure a faster recovery of our economy.

Concerns over the renewed and accelerated spread of the virus from October onwards, primarily in Europe, led the Executive Board to act proactively and pre-emptively in its November meeting and ensure the option of using additional cheap dinar liquidity. On a regular weekly basis and for a three-month period, banks will be able to obtain dinar liquidity via two lines – additional FX swap auctions (Mondays) and securities repo auctions (Thursdays).

It is important to note that all measures undertaken by the NBS resulted in a further convergence of interest rates on dinar loans to interest rates on euro-indexed loans, especially with corporates, which helped drive the dinarisation of receivables up to its highest level on record (36.6% in September), thereby reinforcing financial stability. Also noteworthy is the fact that for the first time, interest rates on dinar corporate loans in August were lower than rates on euro corporate loans (2.9% compared to 3.0%). Though the process of interest rate convergence is lengthy, given that the narrowing has been present for several years already, the movement of these rates at similar levels greatly contributes to easier and less costly corporate financing in dinars.

Text box How strong is the interest rate channel in Serbia? econometrically confirms that the interest rate channel is having an effect on the dinar loan market, and that the NBS’s monetary policy easing and the ensured macroeconomic stability had a critical impact on the fall in interest rates on loans.

The preserved financial stability, confirmed by capital adequacy and bank liquidity ratios, enables banks to continue to provide a strong lending impulse to the recovery of domestic demand going forward.

“There are still challenges ahead of us, particularly during winter when all of our efforts will be directed to supporting the further recovery of our economy, preservation of production capacities, jobs and good results of the export sector, as well as encouraging domestic investments and FDIs. The NBS will continue to keep a close eye on developments and impact of key internal and external factors on inflation, financial stability and the pace of economic recovery. We will continually assess all measures adopted so far and review further needs of our citizens and corporates to provide the necessary support to continued economic recovery, without endangering price and financial stability. In coordination with the Government, the NBS stands ready to respond as the situation with the coronavirus pandemic evolves at home and abroad“, said Governor Tabaković.

Governor’s Office