23/02/2021

National Bank of Serbia as a Catalyst of Innovation

In addition to achieving its primary objectives—monetary and financial stability—the National Bank of Serbia (NBS) is also committed to promoting innovation and strives to act as a catalyst of the development of the Republic of Serbia’s financial system. From my first day as central bank governor, I have placed innovation and digitalization activities high on the list of NBS priorities. In the last eight years much has been done in this field. Not only normative reform, but also many activities aimed at further development of payment infrastructure. Looking back, I can freely say that we have achieved significant results.

First, we implemented a modern, sound and comprehensive regulatory framework for payment systems, payment services and electronic money issuance, in accordance with EU legislation. This way we opened the door for further digitalization and development of innovative payment services and we provided conditions for further development of payment infrastructure in our country. In addition to this, we introduced a mechanism to support fintech development—the Regulatory Sandbox. Video-identification of financial services users has been enabled and now users don’t have to go to the bank premises to open their account, because all that needs to be done can be done from their homes.

Our latest activity included participation in the process of drafting the Law on Digital Assets, which was adopted by the National Assembly of the Republic of Serbia in December 2020 and which introduces a legal framework for digital tokens, virtual currencies and other digital assets.

Also, projects focused on research of the potential for blockchain technology usage for the purpose of central bank’s activities have been analysed, as well as a potential further usage of artificial intelligence.

First Instant Payment System in the Balkan Region

What stands out as one of the most important projects in the field of innovation and payment system modernization is the NBS IPS payment system, launched on 22 October 2018 as the first instant payments system in the Balkan region. Before 2018, the NBS operated five payment systems: RTGS payment system, Clearing payment system, Interbank FX clearing system, International FX clearing system and DinaCard clearing system.

The NBS IPS system is the first payment system in the country that enables instant money transfers, with an average processing time of just 1.2 seconds. The cap on individual transfer orders executed in the NBS IPS system is RSD 300,000 (around EUR 2,500). The system is an extension of the existing RTGS solution and is closely integrated with it, which provides for excellent liquidity risk management.

Our aim was to make instant money transfers available to all citizens and businesses in the country. For this reason, participation in the NBS IPS system is mandatory for all banks which are participants in the NBS RTGS system. Besides the NBS, the Ministry of Finance–Treasury Administration and banks, other payment service providers (payment and e-money institutions) can also participate in the instant payment system, but only as indirect participants. An indirect participant means a participant who cannot be a participant in the NBS RTGS system (important payment system) and who is in a contractual relationship with one direct participant (e.g. a bank) who enables an indirect participant to execute transfer orders in the NBS IPS system (depending on the model an indirect participant can send transfer orders directly to the NBS IPS system or through a direct participant).

Standardization of the Elements of the IPS QR Code

The NBS IPS system gives users not only the possibility to transfer funds any time of the day, 365 days a year, through standard channels for initiating transactions (bank tellers, mobile and electronic banking applications), but many other functionalities as well.

The NBS has prescribed in detail the use cases for the IPS QR codes and their content (at physical and internet points-of-sale and for invoices) and published the relevant technical specification on its website, making it publicly available to all interested parties.

Instant Payments at Points-of-Sale

After introducing instant payments in 2018 for standard payment methods and after standardization of the IPS QR code, the second phase of the project was focused on enabling instant payments at merchants’ points-of-sale. In February 2020 the first instant payment transaction at the physical point-of-sale was made, in the large retail store Mercator S.

First instant payment transaction at the physical point-of-sale in the Republic of Serbia

This retailer also implemented a mobile application for accepting instant payments for its delivery service. By the end of 2020 another important merchant enabled instant payments, this time at gas stations—NIS Petrol, the biggest oil company in the country.

How Customers Make Instant Payments at Points-of-Sale

Unlike some markets where there was one white label application used by all banks in the market, in the Republic of Serbia banks and the NBS decided to enable instant payments in existing mobile banking applications already issued by banks. This means that the customer does not need a new mobile banking application, as he can use the existing one with new updated functionalities that enable the initiation of instant payments at points-of-sale. The authentication process is also familiar to the customer and depends on individual bank solutions which may include, for example, a PIN or biometric authentication.

To initiate instant payments at points-of-sale, IPS QR codes are used as a method (this being a minimum requirement prescribed by regulations).

There are two possible methods for initiation of these payments using IPS QR codes:

Merchants’ Options for Enabling Instant Payments at Physical Points-of-Sale

Instant payments can be made on an infrastructure that is completely independent from the infrastructure used for card payments (such as mobile phone, tablet…), but they can also be made on the existing card infrastructure (POS terminals). For the purpose of better risk management, the NBS recommends solutions that include independent infrastructure. This way, the merchants having POS terminals and instant payments enabled through independent infrastructure use the mechanisms and controls that provide much more stability for their cashless payments.

Beside the options to use POS terminals or cash registers with the IPS QR code reader, it is possible for merchants to use a mobile application for accepting instant payments. This option is especially interesting and useful for delivery companies or taxi drivers, but also an excellent choice for small merchants who find card payments too expensive due to high fees of international card schemes.

Instant Payments at Online Points-of-Sale

In June last year, just a few months after the introduction of instant payments at physical points-of-sale, we had a first web store that enabled instant payments at the online point-of-sale for its customers. This was one of the biggest publishing houses and book stores in the country. For the time being, there are six web shops offering instant payments to their customers.

One of the main advantages of instant payments over online card payments is the fact that there is no need for a customer to enter any sensitive data about the payment instrument. All that the customer needs to do is use his banking app to scan the IPS QR code presented at the web shop.

When a customer visits a web shop and decides what he wants to buy, he then chooses instant payments as the payment method. After that the IPS QR code is generated on the web shop and using the mobile phone camera via mobile banking application the customer can scan this code and make the payment. The merchant immediately receives the funds.

This solution for instant payments at the web shops implies usage of two electronic devices, for example, a computer and a mobile phone. Currently, we are working with banks on the implementation of a “deep link” solution that will enable online shopping and instant payments using only one device (mobile phone).

It is important to emphasize that all banking apps and solutions for instant payments (e.g. issuers and acquirers) are tested in the NBS IPS TestLab before we approve them and before banks offer them to the clients. This way, we make sure that banks provide secure and efficient payment instruments to their clients.

NBS IPS QR Codes for Invoices

Thanks to the existence of the system and the standardization of the NBS IPS QR code, today invoices can be paid by scanning the NBS IPS QR code printed on the bills and invoices, using a mobile banking application. As the NBS expected, the standardization of the NBS IPS QR code enabled a simple and fast execution of bill payments, and there is great interest in this service from the market.

Issuers of a large number of monthly invoices, such as public utility companies and telecom operators, were the first to offer their customers the option to pay bills by scanning the NBS IPS QR code. We are proud to say that this option is available all over the country, not only in major cities and not only for bills issued by big utility companies. For example, the NBS IPS QR code may be found even in the smallest municipalities or on the invoices for kindergarten services.

In order to further support interested parties who would like to enable instant payments, we provided on our website a special application—the NBS IPS QR code generator and validator. Users may freely generate their NBS IPS QR code using filling elements or string. Thus the generated NBS IPS QR code is in line with the prescribed specification and can be used for initiating payments. On the other hand, the NBS IPS QR code validator enables users to verify whether the previously generated NBS IPS QR code is correct.

NBS IPS Statistics

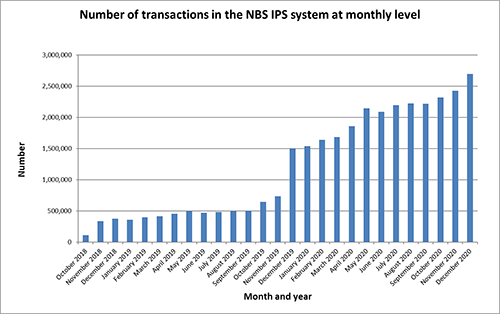

The NBS IPS system has proven to be a success since the start of its operations on 22 October 2018, as evidenced by the constant rise in the number and value of transactions in the chart below.

The total number of payments made on the NBS IPS system from 22 October 2018 until and including December 2020:

The total value of payments made on the NBS IPS system from 22 October 2018 until and including December 2020:

The record number of transactions per day on the NBS IPS system:

Current Activities and Plans for the Future Period

I am very proud of the fact that users have recognized the benefits of the IPS system and that it has received such a positive reception in no more than two years. We continue our work on further modernization of the payment infrastructure in Serbia and improvement of the functionalities of the NBS IPS system.

The “deep link” option for instant payments at the web shops will be enabled in the first half of this year. Another instant payment system functionality will be presented as well—CAS NBS as a service that will enable users to make a payment order only by entering or choosing a mobile phone number from the contact list and entering the amount to be transferred.

Our prediction is that the upward trend in the number of transactions will be maintained in the near future, especially owing to the development of new system functionalities. The number of merchants accepting instant payments also increases every day, and we expect this trend to continue. Besides our work on introducing new functionalities to the system, we will continue to support banks and merchants and their efforts to widen the acceptance network for instant payments, which will lead to further growth of cashless payments in the Republic of Serbia.

I am very pleased that we have succeeded not only in our intention to provide the most modern payment infrastructure to all payment users in our country, but also that we managed to create adequate conditions for further innovation in the field of payments.

CBPN 4.2 – February 2021

National Bank of Serbia

Governor Jorgovanka Tabaković, National Bank of Serbia

Governor's Office