The NBS Head Office Building was built from 1888 – 1890, on the basis of blueprints designed by Konstantin Jovanovic (Vienna 1849 – Zurich 1923), son to distinguished artist Anastas Jovanovic...

19/03/2020

To inform the public about the application of regulations adopted by the NBS with a view to safeguarding financial stability amid potential risks caused by the emergency health situation in the country, we wish to highlight some of the aspects of how this will work in practice.

As the regulations were published in the RS Official Gazette of 17 March 2020 and entered into force a day later (18 March), banks and lessors are obligated to offer a moratorium on debt payments to their clients over the next three days (until 21 March) by posting a notification of such offer on their websites. Within ten days following the notification, borrowers/lessees can refuse the offer, and if they fail to do so, on the tenth day it will be considered that they have accepted the offer. The moratorium produces legal effect as of the expiry of the ten-day period following the publication of the offer. Hence, banks/lessors have the right to charge loan/leasing instalments due for payment until the day the moratorium starts producing legal effect (which, depending on the day of publication of the offer, may be no later than 31 March 2020), unless the client explicitly demanded the moratorium to be applied before the expiry of that timeframe (running from the date the offer was published).

The moratorium is a suspension of repayment of loan, as well as all other obligations to a bank. Borrowers repaying more loans are entitled to a moratorium on the repayment of instalments for all loans. If borrowers continue to settle their obligations on time after the publication of the offer, this does not prevent them from applying the moratorium during the emergency state period. For instance, if a borrower did not refuse the moratorium offer within the prescribed timeframe and did pay one due loan instalment, in the month thereafter the moratorium will automatically apply to that borrower too if he fails to pay the next loan instalment.

For the duration of the emergency state declared due to the pandemic, banks will not charge any default interest on past due outstanding receivables. The moratorium lasts for at least 90 days, i.e. for the duration of the emergency state declared due to the pandemic. Once the moratorium ceases, borrowers will continue to repay their loans, which means that their repayment terms are practically extended by three months. Naturally, if borrowers request a different method of repayment, more suited to their needs, banks should do their best to find appropriate solutions. As regards the regular (agreed) interest charged by banks during the moratorium, it will be accrued to debt and distributed evenly over the remaining maturity.

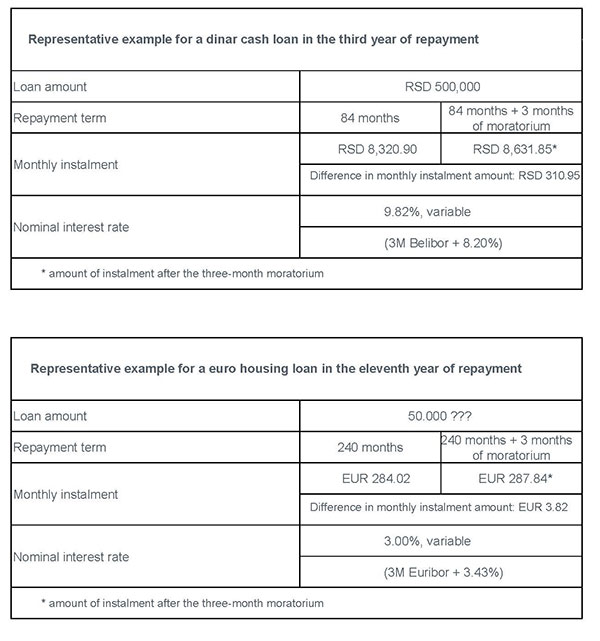

For clarification purposes, please have a look at the two representative examples below which illustrate the application of the Decision on Temporary Measures for Preserving Financial System Stability on cash and housing loans.

Governor's Office